Every year thousands of people are owed a tax refund – and it’s down to individual taxpayers to check they are paying the right amount of tax. This guide will help you determine if you are owed a tax refund – and tell you how to claim one.

What is a Tax Refund? (or Tax Rebate)

Anyone who receives income via employment, or a significant income via a private pension, will pay income tax to HMRC. This is true whether you are self-employed, or paid by an employer via the Pay As You Earn (PAYE) system.

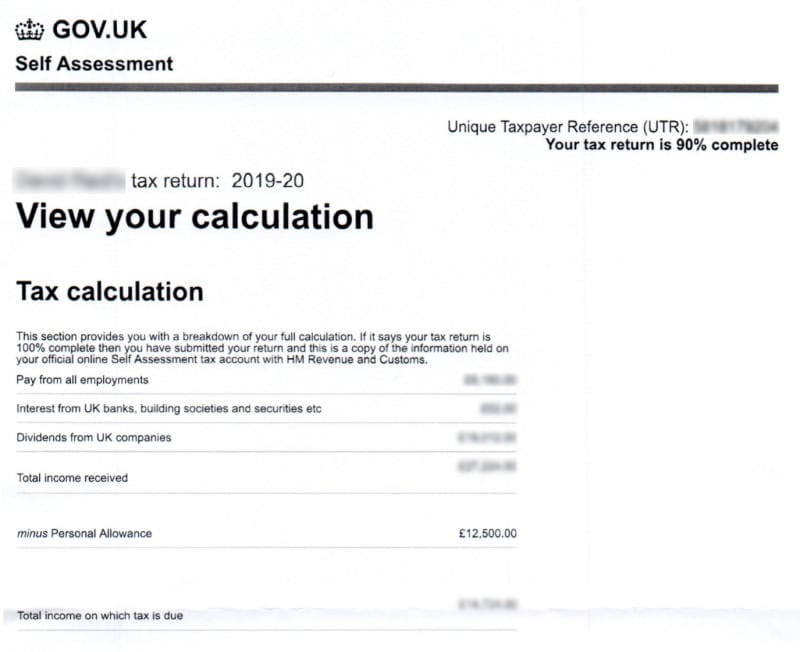

If you are employed or get a pension, your employer or pension provider uses your tax code to work out how much tax to deduct from your pay. If you are self-employed, you will complete a self-assessment tax return to help HMRC determine how much tax you will pay.

Every tax year thousands of people are notified that they have paid too much tax and are issued refunds by HMRC. There are a number of common reasons why you may have overpaid, but it’s usually due to a change in your employment circumstances – for example if you started a new job, or had a period of unemployment.

COVID19 & Tax Refunds

Due to the effects of the COVID19 pandemic, many people experienced changes in their employment or income between 2020 and 2021. This means that millions more people than usual may have overpaid tax due to a change in circumstances.

Your Guide To Claiming A HMRC Tax Refund

The good news is that HMRC should automatically refund you if you have overpaid tax.

However, if you do not receive any correspondence from HMRC, you can still contact them directly if you think you might have overpaid. You can use online tools to calculate the amount of tax that you should have paid – and compare it to what you actually paid.

In this guide we’ll explore:

- Common reasons why you might be owed a tax refund

- How to check whether you are owed a tax refund

- How to claim a tax refund

- How long you can expect a tax refund to take

Common Reasons Why You Might Be Owed A HMRC Tax Refund

If you are self-employed and complete a self-assessment tax return, you may be owed a refund if your tax return contained errors or incorrect information.

For those who are – or are usually – paid via their employer through the PAYE system, you might be owed a tax refund if your employment circumstances changed within the last tax year. Common examples include:

- You went from working full-time to part-time – or vice versa

- You started or stopped receiving state benefits such as a carer’s allowance, state pension or bereavement allowance

- You started a new job and were placed on an emergency tax code for a period of time

- Your employer was using the wrong tax code

- You only had a job for part of the tax year – for example if you became redundant

- You held multiple jobs at the same time

You may also be due a refund if the level of taxable income outside of your employment income changes – for example any income you receive from property rental.

How long do I have to claim a tax refund?

You can claim a tax rebate within four years of the end of the tax year in which you believe you overpaid.

How To Check Whether You Are Owed A Tax Refund

Do HMRC automatically refund overpaid tax?

Yes – HMRC automatically checks the amount of tax that you pay. If they determine that you have paid too much tax (or too little!) they will send you a P800 tax refund calculation.

However, their calculations will only be accurate if the information they hold about you, your income and your allowances are correct. This is why it’s important to check for yourself that you are paying the right amount of tax.

Receiving A P800 Tax Calculation

If HMRC determines that you have not paid the right amount of tax for a given tax year, you will be sent a P800 or a Simple Assessment tax calculation. If you are owed a refund, the P800 will tell you what you need to do in order to claim it.

There are two mechanisms:

Claim Online – You may be asked to claim your refund online. Once you have submitted your claim, you can expect to receive your money within 5 working days if you’re using a UK bank account.

Receive a Cheque – Alternatively, you may be told that HMRC will send you a cheque. You’ll get your cheque within 14 days of the date on your P800.

If you are invited to make a claim online but fail to do so within 21 days, HMRC will send you a cheque. It should arrive within 6 weeks of the date on your P800.

Haven’t Received A P800? Use The UK Gov Income Tax Refund Calculator

What if you have not received a P800, but still think you may be owed a refund? In these instances, you can use the UK government’s tax refund calculator to estimate the income tax you should have paid for the previous tax year.

You will need to provide details such as your earnings, any savings that you have, and any gift aid donations that you have made.

Note that the online calculator only provides an estimate. However, if there is a significant discrepancy between the figures it provides and the tax that you paid, it is worth contacting HMRC.

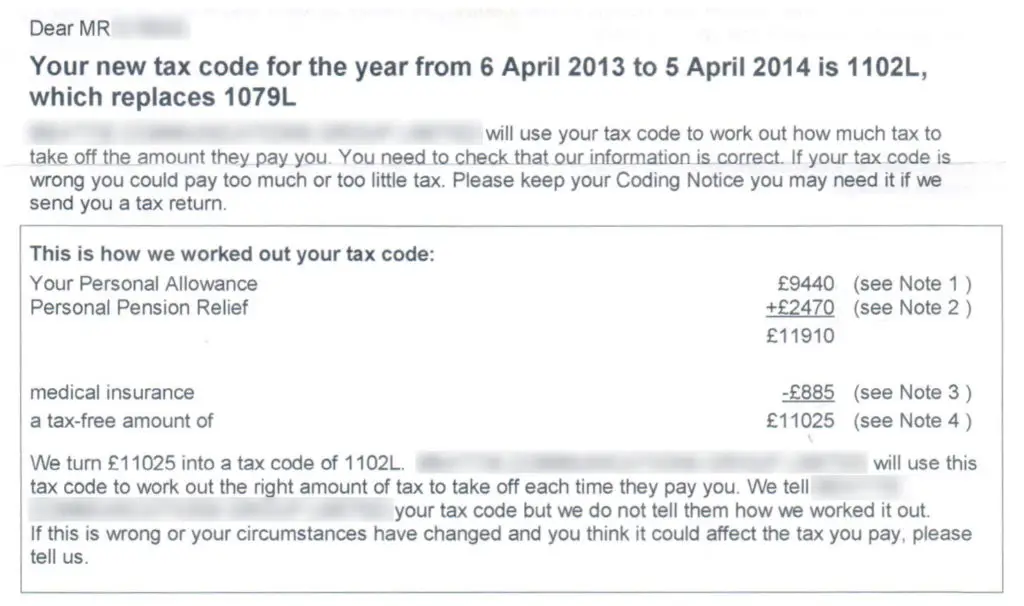

Are you on the correct tax code?

A common reason why you might have paid the wrong amount of tax is because you were placed on the wrong tax code.

If you are working as a full-time or part-time employee you will be assigned a tax code by HMRC. Your employer will use this tax code to calculate the amount of tax that should be deducted from your wages.

If you receive a private pension, your tax code will be used by your pension provider to deduct the necessary amounts from your payments.

If you work for multiple employers, or work and draw a pension at the same time, you’ll have more than one tax code. If you are fully self-employed or only receive a state pension, you will not be given a tax code.

Where can I find my tax code?

Your tax code takes the form of a short sequence of letters and numbers – for example “1257L”.

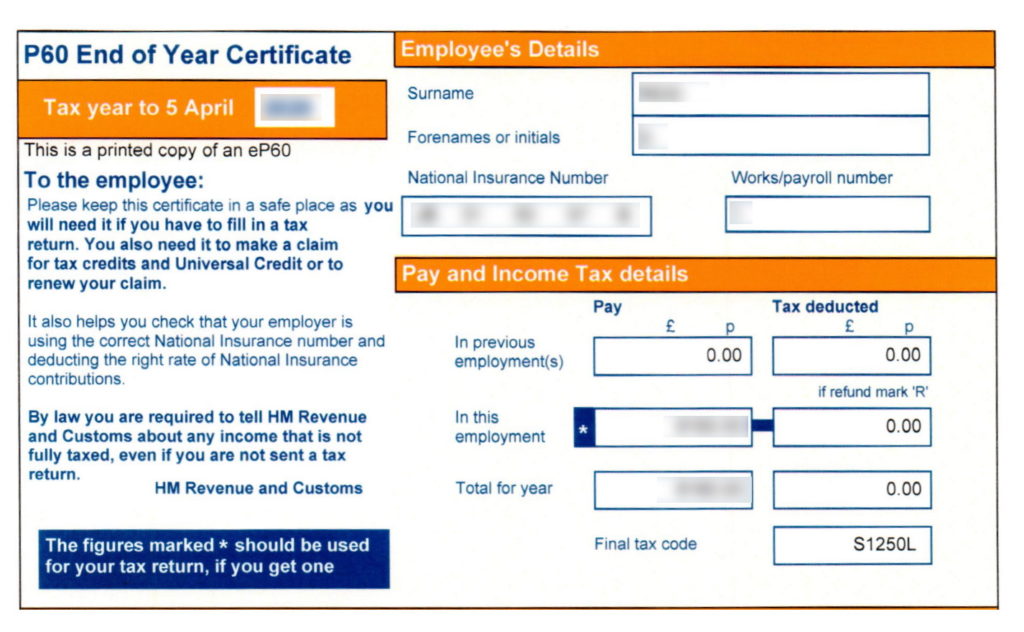

Your payslip is probably the easiest place to find and view your tax code. It will also appear on other standard tax documents such as a P45 (which you receive when you leave a job) or a P60 (your annual summary of tax deductions). If you receive a pension, you can find it on your Pension Advice Slip.

What do the numbers on your tax code mean?

The numbers on your tax code represent how much tax-free income you can earn each year.

Taking “1257L” as an example – this indicates that you can earn up to £12,570 each year without paying tax on that income.

For many people, the numbers on their tax code will match the Tax-Free Personal Allowance set by the government each year. For 2021/2022 the Personal Allowance is £12,570 and you can check rates for the current year and previous years here.

For others, especially those who receive employee benefits such as a company car or healthcare, the figure may be different. Tax-free allowances such as Charitable Gifts and Pension Contributions can also affect how much tax you pay.

If you think that the numbers on your tax code are incorrect, it’s a good idea to use the gov.uk income tax calculator to get an estimate of the tax you should pay – and contact HMRC if you think there is a discrepancy.

What do the letters on your Tax Code mean?

The letters on your tax code are taken from a predefined list of individual letters and letter sequences. They indicate your personal situation in relation to your tax-free personal allowance. Common example are:

“L” = An employee who is entitled to the standard tax-free personal allowance

“BR” = For when an employee has a second job, or a pension.

“C” & “S” = For an employee whose main home is in Wales (C) or Scotland (S)

To find out what your tax code letters mean and to determine whether the letters used on your tax code are correct, you can view all the code variations on the gov.uk website here.

How To Claim A HMRC Tax Refund

If you believe that you are owed a tax refund, or are paying too much tax due to an incorrect tax code – you have three main options open to you in order to claim back tax from HMRC.

Option 1 – Your online personal tax account

For many people, the easiest way to claim a tax refund will be via their online tax account on the gov.uk website. As well as claiming tax refunds, you can also use this portal to manage your taxes – including updating your personal details, viewing historical records and tracking submissions.

You can register for a new online account or sign into an existing account here.

Option 2 – Contact HMRC online or by telephone for tax refund

If you think you have paid the wrong amount of tax, you can also contact the HMRC directly to claim a tax refund online, via telephone or by post. Contact details for each method can be found on the gov.uk website here.

The UK HMRC contact number for tax refunds is 0300 200 3300. This is a freephone number and the telephone lines are open from Monday to Friday 8am to 6pm (excluding bank holidays).

Before you contact HMRC, it may be useful to gather information relevant to your situation. This might include your personal details, national insurance number and current tax code – but also details about your employer or pension provider.

Option 3 – Contact an Accountant who is a tax specialist

It’s possible to get assistance in claiming tax back through a specialist HMRC tax rebate service or an accountant.

Getting support may be particularly advantageous if you believe you are eligible for a significant refund, or refunds across multiple years (remember – you can claim a tax refund for the previous 4 tax years).

People also choose to get help with their taxes because contacting HMRC can be a time-consuming process, or because they are daunted by having to work out what they might be owed.

If you’re interested in getting help with a tax refund – you can use our free service to receive quotes from highly rated accountants near you. It only takes 90 seconds to receive costs, compare package details and view past customer reviews.

Common Tax Refund Questions

How long does it take to get a tax refund from HMRC?

The amount of time it takes to process a tax refund can depend on a variety of factors – including:

- The time of year that you apply

- The complexity of your circumstances

- The amount that you are claiming for

A tax refund can take up to 12 weeks to be processed – but it can also be much shorter! Tax refunds are actioned much quicker if HMRC have already identified an error and have sent you a P800. Rebate claims which start with you contacting HMRC will take significantly longer.

How long does it take for an HMRC tax refund to go into the bank?

You can expect to wait for the following periods of time – depending on your situation:

You receive a P800 and claim online: The money is usually in your account within 5 days

You receive a P800 which says that HMRC will send you a cheque: The cheque should arrive within 14 days of the date on your P800

You do not receive a P800 and contact HMRC: You may need to wait for up to 12 weeks from when you first contacted HMRC

To increase the chances of HMRC processing your claim in a timely manner, it’s important to have any relevant documents to hand when contacting them. You may also be asked to provide copies of certain documents – do this promptly to help speed up the process.

Can I track my tax refund claim?

There is no specific mechanism to track a tax refund or tax rebate status. However, you can contact HMRC to request a status update on your tax refund.

You can use the same contact details that you would use to submit a claim.

Think You Might Have Overpaid Tax? Don’t Delay In Making A Tax Refund Claim

The vast majority of tax is collected correctly – however for each tax year there are millions of people who are owed a refund.

It’s important to remember that, while HMRC should contact you automatically if you are owed a refund, it’s up to you as the taxpayer to ensure that you are paying the right amount.

We hope that this guide has helped you to understand the circumstances in which you might be owed a tax refund – and how to make a claim if you think you are eligible for one.

Remember that if you think you might benefit from support in making your claim, you can use Rated Near Me Accountants to get quotes absolutely free!

Please Share

If you liked this free guide, please share it with your friends and colleagues.